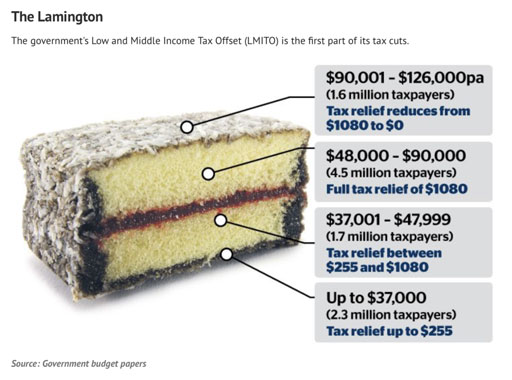

This graphic from The Sydney Morning Herald gives a handy visual explanation of taxpayer entitlement:

Why does Australia need tax cuts?

The rationale behind the cuts addresses the stagnation of pay rises in comparison to historical norms. Meanwhile the cost of utilities, food, transport and other living costs have gone up. This has reduced disposable household income. The 2019 tax offset is designed to help ease the squeeze, whilst stimulating spending.

How you can make the most of your tax bonus….

It’s always nice to get a bit extra back into your pocket, but it can also far too easily fly right back out again. Leaving you with nothing to show for it. When I was chatting with my sister about her tax bonus, I teased her about spending it on more shoes and handbags. She asked me what I’d do with it.

That’s easy. I’d invest it in myself every time, and I’m not talking shoes and handbags. I’d focus on turning it into a whole lot more….

The research is clear in Australia – the higher our level of education, the more we earn.

That’s why when I started rebuilding my life after I left police, I invested in qualifications that gave my service career meaning on the outside.

You are your biggest asset when it comes to securing a new job or simply ensuring you are secure in the one you have, so it makes sense to invest bonus cash windfalls in making yourself as valuable as you can to your existing or potential employer.

Find out what you’re eligible for

Before taking the plunge and investing either time, money or both in yourself, take the time to consider a few things:

- What do you want from a job? The answer may not be as simple as you think. Rather than focusing on the obvious things, like money, think about what you enjoy doing, what you excel at, and what motivates you. If your needs aren’t being met in your current role, look at jobs you think could fulfil these needs and make a plan to get there.

- Have confidence in your abilities. You should be proud of the experience you’ve gained over your career. Unfortunately however, most employers wont take your word for it – they will want to see the proof nationally recognised qualifications provide. Recognition of Prior Learning is an assessment method that allows you to offer up your years of on the job experience as your life exam for qualifications.

- Identify gaps and obstacles. What’s stopping you from landing the job you want? If it’s a formal qualification or a training gap, these are things that can easily (and surprisingly quickly) be fixed. Using recognition of prior learning can shorten your time to complete a qualification to as little as 14 days. If you’re willing to invest either the time or money in receiving formal qualifications, training or both, you may find these gaps and obstacles are easily overcome.

Whatever you do with your tax return this year, make sure it is an investment in you – because you are your number one asset.

References & Further Reading

- https://www.ato.gov.au/General/New-legislation/Lower-taxes-for-hard-working-Australians-Building-on-the-Personal-Income-Tax-Plan

- /https://www.smh.com.au/politics/federal/tax-cuts-how-much-will-you-get-this-year-and-beyond-20190704-p5242b.html

- https://www.abc.net.au/news/2019-07-04/tax-cut-explained-what-will-you-get/11277190

- https://www.theguardian.com/australia-news/2019/jul/05/income-tax-cuts-explained-how-much-money-will-i-gethttps://www.afr.com/news/economy/the-income-tax-cut-package-explained-20190701-p5231a

Image credit: Fraser Coast Chronicle